Liberia: Cummings Vows Changes to Liberia’s Tax Holiday Regime

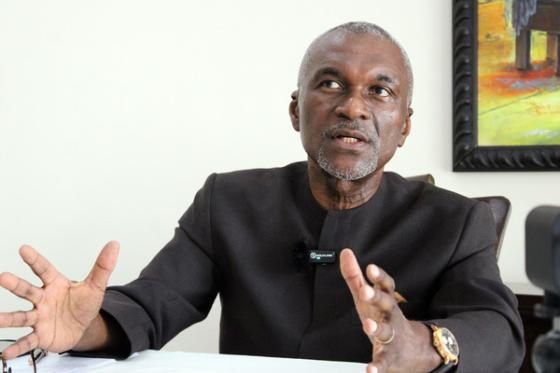

Alexander Cummings, the Presidential Candidate of the Collaborating Political Parties (CPP)

— “If anyone comes and is given a tax break for six months, knowing that at the end of that time, you will begin to make money, the tax break must end right at that time because you will start to make money by then,” says Cummings.

Alexander Cummings, the Presumptive Presidential Candidate of the Collaborating Political Parties (CPP), has said that, if elected president, his administration would review existing tax breaks and other incentives to eliminate abuse.

According to Cummings, his focus on investment incentives stems from the fact that companies get tax breaks, which are not justified by the investments being made, and the return on investments to the Liberian people.

His plan, he says, would also focus on reducing the duration of tax breaks already given, and other incentives, if a “continuation is not justified by the investment.”

“We will halt tax breaks and other incentives the moment the recipient investment becomes profitable,” says Cummings, who is one of the few opposition politicians with a clear chance of unseating President George Weah. “If anyone comes and is given a tax break for six months, knowing that at the end of that time you will begin to make money, the tax break must end right at that time because you will start to make money by then.

“If someone comes and invests a hundred million dollars and in five years they will begin to make money, the tax incentive should end at the end of the five years given them because they will start to make money,” Cummings noted.

Cummings’ focus on the country’s tax break and incentives regime follows warnings by the World Bank and the International Monetary Fund that too many tax holidays were narrowing the country’s revenue basket.

These tax breaks, which have swelled in the last two decades, have made Liberia heavily dependable on external support to fund almost all of its development projects, as well as revenue in the form of budget support.

The World Bank in particular has asked the Liberian government to narrow tax breaks and incentives and remove or streamline duty duty-free privileges for lawmakers and other exemptions granted in concession agreements as a means of raising enough revenue to unlock the country’s potential.

In a report, Liberia Domestic Revenue Mobilization Policy, the Bank noted that while tax concessions are a universal feature, the extremely narrow tax base in Liberia, as well as the lack of scrutiny on granting incentives and the fiscal implications, calls for changes to minimize real costs in form of foregone revenues.

One risk factor with tax breaks, according to a 2018 study by the United Nations Department of Economic and Social Affairs Financing, entails revenue loss, low economic efficiency, and increased administrative and compliance costs, which considerably erode the general tax base; and in some cases, few new investments, with a significant cost to the government.

And in February, the Liberia Revenue Authority strikingly revealed that the country was losing over US$300 million annually to tax breaks and other investment incentives.

The revelation comes as Liberia's national budget is yet to reach US$1 billion and, for the fiscal year 2023, the budget was down by nearly US$29 million. The drop comes as the country continues to collect minimal public revenues from many large-scale investments as a result of a narrow tax base.

In the fiscal year 2022, the national budget stood at US$806.5 million but this year, it stands at US$777.9 million. Of this amount, US$667.9 million of the proposed budget would come from domestic revenue, while external resources on-budget account for US$110 million.

“We are given bigger targets and are pushing ourselves to meet, but there is a need to consider the impact of tax incentives and other generous policy regimes in the revenue basket,” Gabriel Montgomery, the Deputy Commissioner General for Technical Services at the Liberia Revenue Authority said at a legislative budget hearing in February.

“Each year, more than US$300 million is lost to tax waivers and incentive programs. We believe that incentives can be good if they are targeted toward investment and growth promotion. There is a need to revisit our incentive policies and monitoring frameworks to safeguard our revenues,” he added.

And so for Cummings, expanding the country’s budget would mean looking at the current regime for tax breaks and incentives to remove abuse of the provision, while innovating ways for investors to remain constructively engaged in the Liberian economy.

According to him, tax holidays of whatever kind would be determined on a case-by-case basis under his administration so as to avoid giving them “out undeservingly.”

Tax breaks, he says are not bad if they are used properly but argues that the current system in Liberia has been abused.

“Now, tax incentives have been abused. Those benefiting do not deserve them because they are not creating a lot of jobs,” Cummings says. “Some of the entities receiving tax breaks actually begin to make profits from day one of their investments but do not pay taxes because we gave them undeserved tax breaks, seemingly in perpetuity. This is wrong, and cheats the Liberian people.”

“I want to let the Liberian people know that under a Cummings administration, we will clean up the tax-breaks loopholes. We will fix it, and we will only give tax incentives when it makes sense to do so. We will fix the abuse and corruption in the process.”

Cummings also noted that his administration will not permit fronting a foreign-owned business as Liberian-owned to evade taxes and other payments to the government.

He says that his administration would encourage and promote Liberian partnerships with foreign businesses, but will not tolerate the shielding of foreign businesses.

Growing the economy, ensuring food security through Agriculture

Speaking of investment, part of Cummings’ business-friendly economic vision to grow the economy involves agriculture.

He wants to ensure food security by formalizing the agricultural sector which, in his view, has the ability to greatly transform the country, and which cannot happen due to the largely informal state of the sector.

The plan would see investment in extension services, infrastructure, technology, and the provision of financing facilities to farmers.

The issues of access to credit for farmers, according to Cummings, would be prioritized as he wants farmers to invest in expanded operations for productivity.

“Our economy is mostly agro-based. As such, it should be expanded and leveraged. However, it is not big enough because we have not invested enough into it,” he says.

“The rest of our people are basically dependent on farming, which is an informal economy. We can nurture it and formalize it [by] providing loans. We have to provide the facilities required to grow it. We import everything we consume. We need to change that.

“We will fix the basic infrastructure and will have agriculture as our primary base for growing the economy. This country is the first Republic in Africa and is among the least developed countries in the world. This situation cannot go on. We have to grow the private sector in order to grow the economy.”

The key to Cummings’ plan is the establishment of the Liberia Agriculture Extension Service, whose function, he says, would include the provision of technical service to farmers “so as to improve and increase production.”

The former Coca-Cola Senior Executive is of the belief that limited extension services over the past years have made it difficult for Liberian farmers to compete regionally and globally.

“We [will] invest in our farms, in agriculture, and make sure we are improving on a larger scale. We [will] make sure we provide financial support, credit facilities for farmers to buy their fertilizers, their seedlings or seeds, and equipment.

“We [will] re-establish [the] Liberia Agriculture Extension services so we can give our farmers new skills and we will make sure there is an institution that buys what the farmers grow,” he says. “We have to stop our economy from being solely dependent on the extractive industry like gold and diamond to being a truly agriculture-based economy.”

Cummings’ vision for the Liberian agriculture sector comes as farmers across the country are finding it difficult to access the credit they need to purchase inputs such as seeds, fertilizers, and equipment, which makes it difficult for them to modernize their farming practices or invest in new technologies that could increase their productivity.

The lack of infrastructure in rural areas is also a major challenge for Liberian farmers as poor roads and limited access to markets make it difficult for farmers to transport their crops to market or to access the inputs they need to improve their yields.

This lack of infrastructure also makes it difficult for farmers to access important services, such as extension services that could help them improve their farming techniques.

“This, too, is why we must ensure that farmers have available facilities and capacities to store their yields. Without adequate storage facilities, we have seen productivity minimized,” Cummings said, adding: “We must increase production, not minimize it, by removing hurdles faced by farmers.”

Editor’s note: The interview with Mr. Alexander B. Cummings is part of a policy-based interview series the Daily Observer intends to have with all presidential candidates.